How Hard Money Georgia can Save You Time, Stress, and Money.

Wiki Article

Some Ideas on Hard Money Georgia You Need To Know

Table of ContentsThe Best Strategy To Use For Hard Money GeorgiaWhat Does Hard Money Georgia Do?Hard Money Georgia Things To Know Before You BuyHard Money Georgia Things To Know Before You Get This

As you can see, exclusive cash financings are exceptionally flexible. It could be argued that exclusive lendings can put both the loan provider and also consumer in a sticky situation. For instance, say the 2 celebrations are brand-new to property financial investment. They might not know much, yet they are close to each other so wish to assist one another out.

Despite them requiring to meet specific standards, private borrowing is not as controlled as tough money financings (in some instances, it's not controlled at all).- Experienced capitalists understand the benefits of matching their private money resources with a tough cash lender.

Hard Money Georgia for Dummies

Nonetheless, most of all, they're accredited to lend to investor. Therefore, they're usually a lot more skilled in solution and turn style investments than your ordinary personal money loan provider. Probably a slight disadvantage with a tough cash loan provider relates to one of the characteristics that connects personal and tough cash car loans law.However, depending upon just how you check out it, this is likewise a strength. It's what makes difficult money lending institutions the much safer choice of both for a very first time financier as well as the reason that wise investors remain to decrease this course. WE LEND PROVIDES A VARIETY OF PROGRAMS TO MATCH EVERY TYPE OF RESIDENTIAL INVESTOR.

Hard Money Georgia for Dummies

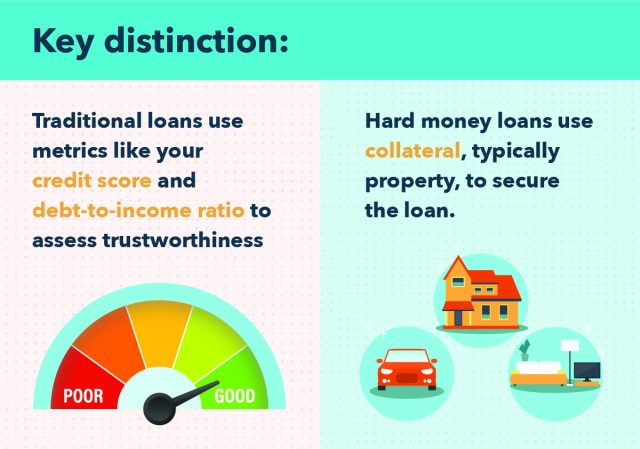

Though it's usually possible to obtain these types of financings from personal lending institutions that do not have the very same demands as typical lenders, these personal finances can be much more costly as well as less advantageous for customers, due to the fact that the threat is a lot greater. Typical lenders will take a comprehensive appearance at your entire monetary scenario, including your earnings, the quantity of financial obligation you owe various other loan providers, your credit report history, your various other properties (consisting of cash money reserves) as well as the size of your down payment.

Difficult money finances have numerous benefits over service lendings from financial institutions and various other mainstream lenders. Unlike typical fundings, which are provided by financial institutions or other monetary institutions as well as are based largely on the customer's credit reliability and revenue, difficult look what i found money loans are issued by personal capitalists or firms and also are based primarily on the value of the property being used as collateral. Because of the danger taken by the financing companies, rate of interest prices are normally greater than the typical house financings.

The Ultimate Guide To Hard Money Georgia

Tough cash financings commonly have greater rate of interest rates and fees than conventional car loans, as well as have shorter terms. One fantastic benefit is that the lendings are much easier to access; therefore, if you don't meetthe qualifications of the conventional lender, lending institution can easily access the loan without undergoing rigorous undertaking. A tough money lending is a loan collateralized by a difficult asset (in the majority of cases this would certainly be genuine estate).Report this wiki page